Semiconductor Devices and Equipment on a Record-breaking Spree but Materials Don’t Seem to Follow Suit

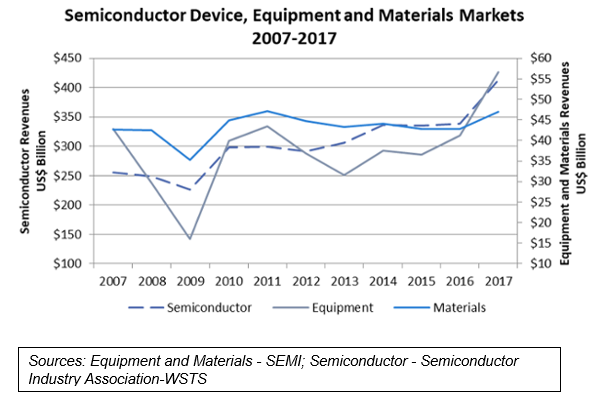

The demand for semiconductors and its allied segments are only increasing with time. Market research firms have reported that the devices and equipment market have surpassed the forecasted growth of 5%. The devices and equipment market logged a growth of 22% and 37% respectively, and thus surpassed their historical high!

However, the materials market has a different story to tell.

In this article, we’ll discuss these trends and what were the driving forces behind the same.

Semiconductor Devices

If we go back and have a look at the income generated during the year 2007, the graph indicates a figure of around 250 Billion USD and which dipped down to 230 Billion USD. The situation has since then improved tremendously and touched the magical number of 55 Billion USD.

These changes can be attributed to the surge in semiconductor silicon shipment volumes along with the silicon revenues crossing the 21 percent mark.

Equipment Catches Up with the Devices Market

It has been rightly said that history repeats itself!

The manufacturing equipment industry was successful in shattering its own record that was set 17 years ago. Worldwide sales of semiconductor equipment totaled $56.6 billion in 2017.

Most of the related segments also saw a substantial growth, that includes –

- Front End segment (including Wafer Manufacturing, Mask/Reticle, and Fab Facilities equipment) increased 40 percent.

- Wafer Processing equipment grew by 39 percent.

- Assembly and Packaging and Test equipment segments expanded 29 percent and 17 percent, respectively.

South Korea got the privilege to bag the top position in equipment rankings and hence ended Taiwan’s 5-year old hold on the spot. What goes around comes back! Korea’s achievement is based on the fact that it set an all-time regional spending record of 17.9 Billion USD.

China retained its 3rd position, followed by Japan and North America in the fourth and fifth positions respectively.

The Materials Industry is Taking It Slow and Steady!

The fab and packaging materials together constitute the global semiconductor materials market. It jumped to 10 percent in 2017 with a value of 46.9 Billion USD. However, some factors have cut the demand for substrates and hence the downward pricing trend amongst manufacturers.

What’s in Store for 2018?

As always, the forecasts for this year point in a positive direction.

The strong, monthly data for silicon shipments, mass flow controllers, lead frames, and semiconductor equipment for 2018 bear testimony to this prediction.

So, the semiconductor industry, as a whole, doesn’t seem to let down its investors and key people anytime soon.

Comments

Post a Comment